Of several diliar into medical practitioner real estate loan, both named your doctor mortgage. Medical practitioner finance is actually a variety of home loan which enables doctors in order to create a deposit off lower than 20% and prevent investing in individual mortgage insurance coverage (PMI). There are many different banking companies offering doctor mortgage brokers. Several is national, others is local. When you look at the per county, there are at the least numerous financial institutions that have good d. This site will give an introduction to doctor lenders and you can what you should consider when inquiring about a great bank’s d.

Conventional Mortgage loans

Towards general people, a conventional home loan ‘s the normal brand of mortgage some one go after. A common specifications that most folks have read is that you should have a great 20% advance payment to purchase property. According to variety of property you are to purchase (domestic, condominium, etc.), this may not be completely true. Sure, for those who have an effective 20% down payment, the choices abound. But not, really banking companies allows individuals to get below 20% down but still safer investment. The fresh new hook is, they require one spend an extra fee every month to fund the price of personal mortgage insurance, otherwise PMI.

What exactly is Private Home loan Insurance policies (PMI)

Personal financial insurance policy is insurance rates you buy to purchase home loan equilibrium just in case you default on the loan. Which became well-known on aftermath off monetary laws pursuing the 2008 houses debacle. Most loan providers immediately tend to be PMI inside the loans where in fact the down payment is actually lower than 20% of your cost. PMI typically costs an additional $100-300/times which can be added on the financing bundle and generally paid back through the escrow membership. It is sometimes built into the mortgage in itself and you may will not reveal up because an extra line item.

In order to eradicate PMI regarding the loan, the loan-to-really worth proportion into household must be less than 80%. Like, in the event that a property is purchased to own $400,100000 that have a 10% downpayment, the original mortgage applied for try $360,000. More than a number of years, the home hypothetically appreciates to help you $450,000 therefore the financing balance is paid back to help you $340,100000. So far the borrowed funds in order to value ratio is actually 75.5%, therefore the borrower could well be entitled to remove the PMI pricing off their financing. Constantly a house appraisal (from the borrower’s bills) is required to prove to the financial institution the current house worthy of. In case your PMI is built into the mortgage itself, after that an excellent re-finance are expected to discover the PMI removed in the equation. Due to this fact, if you are considering a loan that requires PMI, it is best to have the PMI while the a unique range goods, this can be removed with an assessment, unlike a great refinance.

Home loans getting Physicians

Banking institutions understand that physicians is unique as compared to majority of folks and generally are glamorous borrowers. He has got jobs security, earn nice revenue, and you can pay its finance promptly plus complete. Thus, particular banking institutions render a different medical practitioner mortgage to attract physicians while the users. As previously mentioned earlier, doctor finance allow dI, even though he is to make a deposit of below 20%.

The prospective market for these types of finance are physicians whom enjoys recently inserted practice. A health care provider exactly who went of while making $sixty,000/year within just last year out-of house so you can $three hundred,000/year quickly, has the ability to conveniently afford the monthly installments for the a good $600,100000 home loan. But not, it almost certainly haven’t saved up the fresh $120,100000 necessary for a 20% deposit. Banking institutions exactly who render good d has actually identified this matter and you can created a remedy because of it. Now, an early on doc can buy our house they need with because little due to the fact zero percent off (depending regarding the d) while not having to buy financial insurance policies!

Full revelation, zero per cent off is only supplied by a installment loans for bad credit in Philadelphia select few local banking companies and is unavailable in every states. A typical doctor loan system will require 5% down for fund less than $750,000 (some is certainly going around $1,one hundred thousand,000) and you may 10% off over people thresholds. When you are getting a lot more than $step 1.5M, very finance companies requires more 10% upon a beneficial dI.

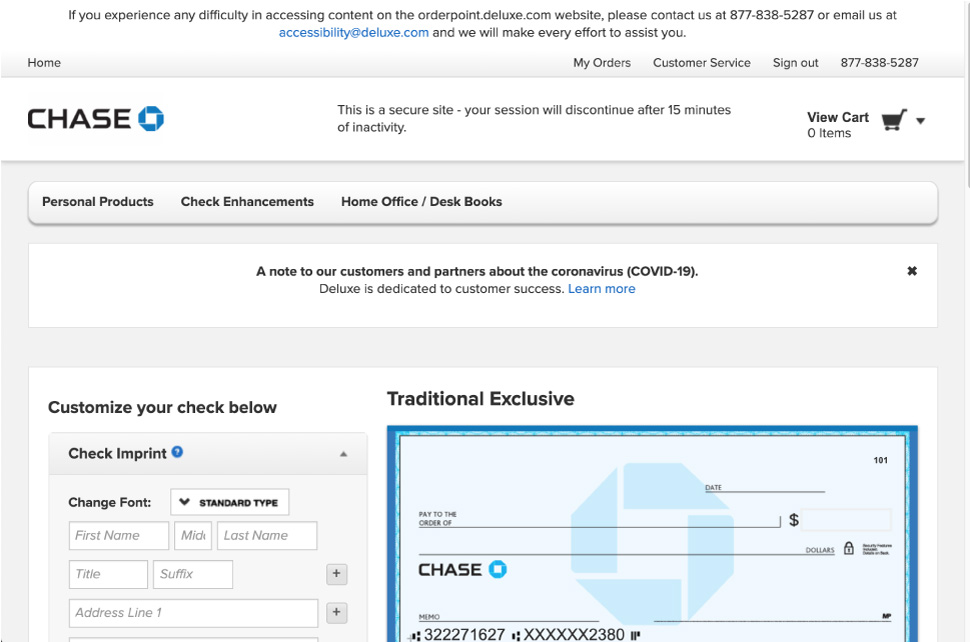

Really medical professionals think they could query any bank in the event the bank has an excellent d and suppose the financial institution understands what they’re writing on. Whenever faced with you to definitely matter, really home loan officials will respond that have, Without a doubt we provide doctor mortgage brokers. They guess youre just asking whenever they render mortgages having physicians, identical to they give mortgages to possess designers, schoolteachers, and you will firefighters. Where situation, the fresh de because the another antique mortgage that have lower than 20% off and can include PMI.

Unlike asking in the event the a bank now offers a health care professional home loan, practical question must be phrased rightly. You might query, Do you really offer physician mortgage brokers that waive this new PMI demands towards fund getting physicians having lower than a beneficial 20% down payment? When they would, you could move on to asking her or him regarding certain requirements.

On the medical practitioner mortgage loan, do you know the minimal down payment requirements for several loan designs? This is where there can be out the restrict loan dimensions when you find yourself getting off 5%, 10%, etcetera.

Remember, the individual human you are working with are perhaps more critical as compared to financial in itself. Whenever you are working with someone in the a bank that gives doctor loans, but the people is not familiar with their d, they probably will not wade better to you. It is helpful to look for that loan administrator whom focuses on medical practitioner lenders no PMI.

Almost every other Ideas on Physician Home loans

Specific banking companies whom promote a beneficial deters for residents/fellows as compared to doctors used. As well as, some financial institutions limit their zero PMI doctor lenders so you can medical professionals in the first decade of its planning to industry. Thinking the following is after ten years used, a physician will be able to conserve sufficient to have a 20% advance payment. As well as, you generally speaking cannot use a health care professional mortgage into the a holiday family or investment property. A doctor loan program is perfect for an individual’s first house just.