Several has and you will apps exists to ease the duty having earliest-go out people, of Government Construction Administration funds on Local Western Lead Loan loans in Superior, CO. (courtneyk / Getty Pictures)

Buying a property the very first time might be challenging. Plus hills from documentation and you will the brand new financial terms and conditions so you can examine, you’ll be able to deal with will cost you and charges that will easily sound right.

In a nutshell, to purchase property actually a financial step when planning on taking lightly. Maybe this is exactly why 74 % from millennials point out that preserving to own a down-payment still means the largest challenge to achieving brand new Western dream, considering a 2016 survey carried out by TD Bank. The latest survey polled over step one,100 People in america offered to invest in a home in the next five years.

Once the FHA insures the mortgage, loan providers located a piece out of protection and will not sense a loss for those who default with the mortgage.

If you have a credit history out-of 580 or maybe more, you may be qualified to receive a mortgage having a downpayment as little as step 3.5 % of purchase price.

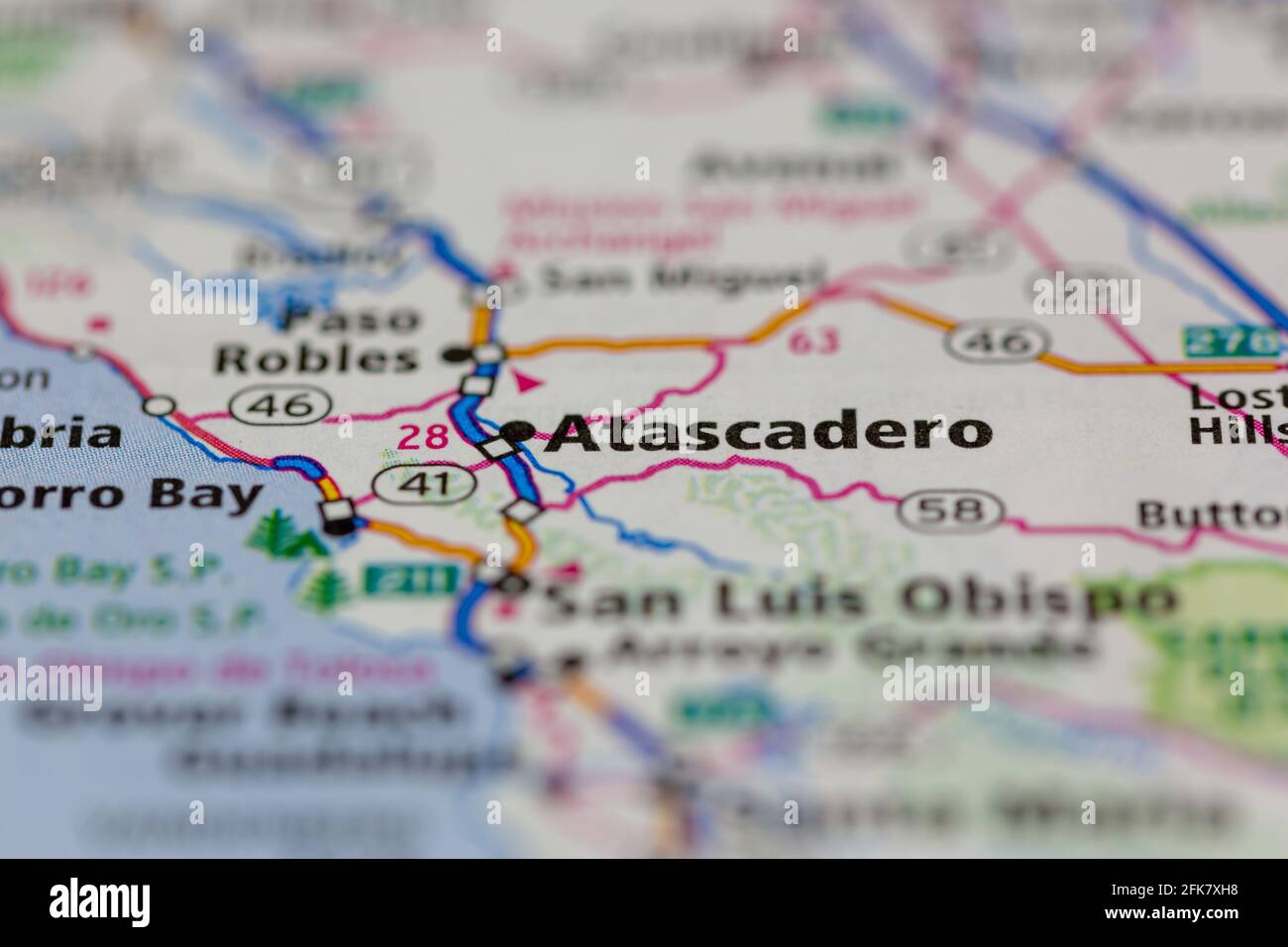

USDA loan: Without really well recognized, the newest homebuyer assistance system of your U.S. Agencies regarding Farming focuses primarily on houses in certain rural elements.

From this settings, the fresh USDA promises the mortgage. There could be no advance payment needed, additionally the loan payments is actually fixed.

Candidates that have a credit history out-of 620 or even more generally speaking located sleek processing. But discover earnings limits, that fluctuate according to area.

Virtual assistant loan: This new You.S. Agency off Veterans Factors facilitate solution members, veterans and you may surviving spouses buy belongings. The fresh Virtual assistant pledges part of the loan, rendering it possible for lenders provide some kind of special features.

The quantity are folded into your number one financing

Va funds provide competitive rates of interest and want zero advance payment. You do not have to pay for personal home loan insurance coverage, so there is not at least credit rating would have to be eligible.

In the event it becomes difficult at some point and come up with payments on the the mortgage, the Va normally discuss with the bank in your stead.

Good neighbor Next door: The nice Neighbor Next-door program is actually backed by HUD and you may centers around getting property aid to possess police officers, firefighters and you can emergency scientific aspects and pre-preschool thanks to 12th-levels teachers.

From this program, you could potentially discovered a discount of fifty percent regarding a good house’s indexed speed for the certain nations known as “revitalization section.”

In fact, you don’t need to feel a primary-go out client so you’re able to reel throughout the masters. But when you complete a deal to acquire a home compliment of the favorable Next-door neighbor Nearby system, you may not individual virtually any home-based a home otherwise features possessed for starters 12 months early in the day.

Utilizing the HUD Homes website (hudhomestore), searching getting properties that are available in your county. Included in the program, you’ll want to agree to residing in our home getting thirty-six months.

Federal national mortgage association and Freddie Mac computer: Fannie mae and you may Freddie Mac try government-backed organizations. They work which have regional lenders giving mortgage solutions one work for low- and you can moderate-money group.

Into the support out-of Fannie mae and Freddie Mac computer, lenders can offer aggressive rates and you will advance payment numbers once the low as the step 3 per cent of the price.

First-time homeowners is also eligible for a home loan training programs with the HomePath Able Visitors system as a result of Fannie mae.

Energy efficient Home loan: This type of loan’s goal is to help you create developments to your home that ensure it is much more eco-friendly. The government supporting High efficiency Mortgage loans by insuring her or him as a consequence of FHA or Virtual assistant software.

An important benefit to so it give is that it allows your to help make an electricity-successful family without having to create a larger down payment.

Federal Property Administration 203(k): If you would like buy a good fixer-higher, this new 203(k) rehabilitation system can be a solid match.

They enables you to acquire the money you’ll want to would your panels and you may comes with them on the fundamental mortgage.

Indigenous American Head Financing: Given that 1992, the fresh Native American Seasoned Head Loan program features aided Indigenous Western experts and their spouses pick house toward government believe lands. This new Virtual assistant functions as the lending company.

Regional very first-day homebuyer provides and apps: As well as the has and you will applications provided by the brand new federal government, of many states and you will locations give let to own earliest-time customers.

This type of mortgage, backed by the fresh FHA, requires into consideration the value of the new household immediately after developments provides come generated

You might like to offered calling a realtor or local HUD-approved casing counseling service for additional info on has and apps that may suit your disease.